Norway’s $850 billion oil fund is meaning to sue Volkswagen AG over its emission-cheating scandal that caused a recall of 11 million cars in the previous year.

The world’s largest sovereign wealth fund stated on Sunday that it plans to join the class-action lawsuits in Germany against the automaker, anticipated to be filed in the coming weeks.

Marthe Skaar, the fund’s spokeswoman said: “Norges Bank Investment Management intends to join a legal action against Volkswagen arising out of that the company provided incorrect emissions data.” The NBIM is assessed to have suffered big losses on its stake on VW after the scandal—a total of 4.9 billion crowns in the fund’s second quarter.

Skaar also added, “We have been advised by our lawyers that the company’s conduct gives rise to legal claims under German law. As an investor it is our responsibility to safeguard the fund’s holding in Volkswagen.”

The Norwegian wealth fund recently urged U.S. oil companies Exxon Mobile and Chevron to do more to report on climate change risks as well.

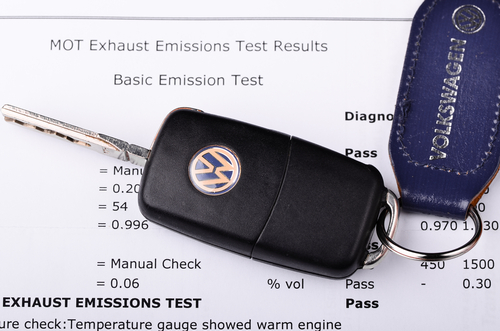

VW confessed that it had used sophisticated secret software in its cars to cheat exhaust emissions tests. This scandal led to the biggest earnings lost in VW history in 2015, prompting the company to set aside $18.2 billion to cover the costs.

“Something this big doesn’t just go away quickly and the costs are spiraling,” Joe Rundle, head of trading at ETX Capital, mentioned in a note. “And if the Norwegian fund is suing VW because the company’s actions led to losses on its investment, then it could open to door for other shareholders to seek redress.”

VW reached an almost $10 billion contract with the U.S. government in April to buy back or repair about a half million of its diesel cars and establish environmental and consumer compensation funds.

Catch the latest market news at TradingBanks daily. TradingBanks reviews market news and provide market analysis to guide the clients with their trading decisions. Open a live account now with us and be the next professional trader!

TradingBanks, your brokers for your success!